Payroll software offers a fast and reliable answer to the current issues of processing your company's payroll.

Choosing a low-cost payroll system is a wise business option that may help you manage your payroll schedule and file your company's taxes with more precision and compliance. So what are the best Payroll Software in 2023? How to choose a suitable software for your business.

Read more!

What Is Payroll Software?

Businesses can automate the management of employee wages and salaries with payroll software. Payroll software is used by human resource professionals to track employee time off, holiday accrual, rewards, deductions, and to manage taxes and reporting.

Read more: 23+ Best Employee Time Tracking Software

What Is Payroll Software Suitable For?

Payroll software helps businesses save time by automating payroll processes. Payroll software assists with this by giving a self-service portal where employees can access their sensitive information, reminding them of compliance needs, and automatically creating reports for filing.

Any business should use payroll software to reduce errors, increase performance, and reduce risk costs. Large businesses definitely need to use it. However, small businesses should still use more economical and simple service packages.

Read more: Top 12 Human Resource Management Software

Tanca Payroll Software Benefits

You may manage payroll yourself or assign it to your accountant, bookkeeper, or trustworthy employee. However, employing payroll software to complete the task has a number of advantages, regardless of who is in charge of it.

Prevent Making Mistakes

Payroll system errors may be a headache. The fact that payroll software lessens the likelihood of those expensive errors happening is one of its many wonderful advantages.

The benefit of payroll software is that it significantly reduces the chance of human mistake and ensures that your employees receive the precise compensation they deserve.

Time-Saving

Payroll isn't exactly what we would call an enjoyable job; rather, it's a necessary one. It's likely that individuals in charge of the payroll don't particularly enjoy the monthly payroll reconciliation.

The advantages of adopting payroll software include making their job easier and saving them a significant amount of time that might be spent on other aspects of the organization.

Cost-Effective

Your interest in maintaining high earnings and low expenses as a small business owner will be personal. You may save a ton of money by changing your payroll processing system from a paper-based one to a more effective payroll software solution.

The cost reductions you obtain from switching to payroll software will grow with your company. With a one-time price, you may add an infinite number of businesses, payrolls, and workers, making the investment wise as your business continues to hire more staff.

As a consequence, your small business will ultimately operate more profitably and with fewer costs.

Data safety

Data security is critical, and payroll data is especially sensitive. Personal information such as postal addresses, DOB, Social Security numbers, bank account information, and so on will be stored in payroll files.

You can make sure that this data is safely locked down and cannot be accessed by anybody outside of your firm by utilizing high-quality payroll software.

Expertise is not required

There is no requirement for payroll experience when using payroll software. This implies you may outsource payroll tasks to personnel with little prior expertise, eliminating the need to hire a "professional." This, in turn, will reduce your expenditures and allow for cross-training inside your small organization.

Understanding Payroll Techniques

Learning how to handle payroll accounting correctly might be incredibly complex. Especially if you lack professional accounting expertise or credentials. As a result, the program is simple and easy to use, easing your pain.

Exact calculations

The amount of documentation that has to be completed will increase as your staff count grows. The greater the amount, the greater the possibility of human mistake. This is due to the process's automation as well as the extensive validation checks and processes.

Best Payroll Software of 2022

Gusto

Gusto provides three payroll plan options, as well as software services such as automatic payroll for salaried staff, direct deposit, limitless payroll runs, wellbeing of employees and benefits management, and tax help.

Its entry-level Simple plan is $40 per month + $6 per employee.

Time monitoring, employee surveys, personal customer assistance, and extra HR and administrative functions are available in higher-tier contracts. Gusto does not impose additional costs for firms with dispersed workforces or that must pay taxes in numerous jurisdictions.

Features:

- Businesses that must file taxes in various states

- Fans of technology

- New ventures

- Businesses that exclusively pay freelance contractors

- People who despise hidden costs

ADP

ADP with nine different payroll choices, businesses of all sizes are sure to find one that meets their requirements.

Roll, the most affordable package, starts at $29 + $5 per employee every month. If your company is medium or big, with 50-999 people, a Workforce Now plan will give possibilities.

Higher-tier solutions include capabilities like HR management, payroll management, and onboarding assistance.

Features:

- Companies who intend to expand

- Businesses that require extensive HR assistance

- People who like to work from their phones

OnPay

OnPay is a single plan with simple price and features. OnPay charges an additional $4 per employee each month on top of a monthly flat cost of $36.

It offers bespoke forms to match your company's demands as well as the flexibility to conduct numerous payrolls for various employee types.

However, because OnPay does not yet have a mobile app, employees must access the website via a web browser on a laptop or tablet. So, if you need access on the road, OnPay may not be the greatest solution due to its lack of mobility.

Features:

- a full range of services at a reasonable cost

- Creating payrolls on different schedules

- Complete online or phone client service

Patriot

Patriot is an excellent solution for low-budget startups and small companies. Patriot, which had the lowest grade in our rankings, has a Basic Payroll plan that costs just $10 per month and $4 per employee.

Payroll software at this price is incredibly cost-effective, enabling you to process an unlimited number of payrolls at any frequency.

However, if you want Patriot to handle your tax filings, you must subscribe to Patriot's Full Service Payroll package.

Features:

- Nonprofits and small businesses

- Companies looking for simple software that does the job

- Customers who are willing to pay and file their own taxes

Block

Block (previously Square) is an excellent alternative for businesses who just need to pay contractors. The most cost-effective method of paying contractors is offered by Block, even though this shouldn't be an issue with any of the payroll programs on our list of ratings.

Block has one primary payroll software option that costs $29 per month plus $5 per employee. However, Block may manage your payroll requirements for just $5 per worker without the $29 monthly cost if you simply need to pay contractors.

Because Block does not charge a fee for inactive months, it is an excellent alternative for seasonal firms that do not operate every month of the year.

Features:

- Those looking for a free plan with point-of-sale (POS) functionality.

- Those looking for simple hardware that fits the demands of a wide range of retailers.

- Companies looking for employee management, loyalty programs, and other ancillary services.

SurePayroll

SurePayroll offers a low-cost Self-Service payroll plan for $19.99 per month + $4 per payee. SurePayroll's Full Service package is $29.99 and $5 per employee each month if you want it to file and pay your company's federal and state taxes.

In addition, the Full Service package includes an HR counselor and speedier payroll processing. For an extra charge, SurePayroll will also integrate time monitoring, accounting, and local tax filing.

Features:

- Payrolling on your phone

- Small businesses that simply require what they need

- People who want customer service outside normal business hours

- Processing household payroll

Intuit QuickBooks

When it comes to speedy direct deposit, Intuit QuickBooks stands out from the other providers we reviewed. The average company will provide a four-day direct deposit time for a basic plan, with shorter direct deposit durations available for more costly programs.

On the minimal Core package, you can obtain next-day direct deposit with Intuit QuickBooks. With pricier Intuit QuickBooks plans, you can receive same-day direct deposit. That is the quickest option offered by firms in our ratings.

Starting monthly fees for QuickBooks plans are $45 plus $5 for each employee.

Features:

- Comprehensive reporting and meticulous record-keeping.

- Numerous integrations with external apps.

- QuickBooks Online Plus and Advanced both include inventory management.

Paychex

Paychex's entry-level service is Paychex Go, which costs $59 per month and $4 per payee. Although it is the priciest base plan in our rankings, it includes automatic tax filing for the federal, state, and local taxes of your business.

Additionally, Paychex provides the Flex Select and Flex Enterprise programs. For Flex plans, which include beneficial features and services such as a dedicated payroll professional, many connectors, and a mobile app, you must contact Paychex for a personalized estimate.

Features:

- Businesses that are medium-sized and expanding

- Businesses with 50 to 1,000 workers or more

- Organizations having accounting/bookkeeping employees to manage the service

Namely

Namely was created to fulfill the HR and payroll demands of medium-sized organizations.

Payroll may be added to Namely's HR Fundamentals package, which also includes a worker directory, training tools, and org charts. Namely is a solid option for firms who want a single system for HR and payroll.

Features:

- Simple to use UI.

- HR, benefits, and time are all integrated.

- a portal for self-service employees.

How To Choose Payroll Software?

Determine your company's payroll requirements

Before you begin researching the many payroll software options, determine what your company will want in terms of features, pricing, size, simplicity of use, and longevity.

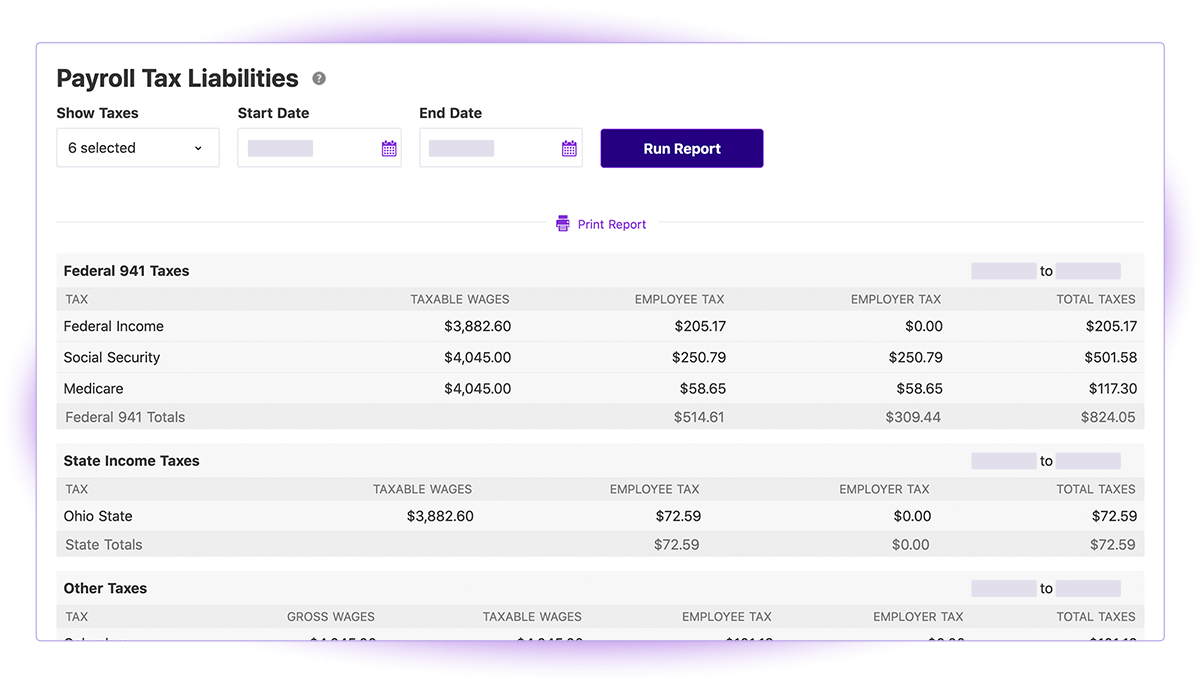

Determine the level of analysis necessary

You must select payroll software that can manage your company analysis needs. Will you have to divide out the business's cost centers for payroll? Is it necessary to examine your payroll expenditures across departments?

Ensure that the software you select can handle your company's reporting requirements by producing accurate reports like payroll summaries, deductions and contributions, tax liabilities, wage and tax summaries, and summary reports.

Comply with payroll laws

Take into account any standard and supplementary payroll regulations that your firm may be required to follow. Federal, state, and local rules will be included. This will help you avoid costly penalties or financial losses by ensuring that your payroll package is legally compliant.

Investigate and evaluate the features of payroll software

Examine the many functions payroll software has to offer, whether they are must-haves or useful add-ons. These consist of self-service terminals, integrations, and tax filings, among other things.

This stage assists in determining the best-suited system for your company, since your feature list will influence the convenience of use and accuracy of your payroll.

Take advantage of free trials

While payroll software may appear ideal on paper, you must test it to ensure that it meets your payroll needs. Consider signing up for free trials if you're considering a variety of payroll software choices.

While the capabilities and usefulness of free trials are sometimes restricted, they do give you the essential tools you need to determine whether the program can keep up with your company's payroll obligations.

Establish your payroll budget

The payroll budget will be an important aspect of many business owners' decision-making process. Your ultimate prices will be determined by the software you use and your company's payroll requirements.

FAQs

Why Is Payroll System Important?

Payroll systems are used by business owners to arrange their operations and save time. Due to the ability to quickly repeat payroll activities as necessary, payroll systems help business owners save time. Payroll structure is essential because of the legal obligations related to employee payroll.

Is Payroll Software Necessary?

Payroll software can assist you in avoiding errors.

The best payroll software will assist you in avoiding the most typical payroll errors by calculating and withholding taxes as well as assisting with end-of-year filings.

Does Small Business Need Payroll Software?

Larger organizations may require more sophisticated features for managing Human Resources (HR) in numerous locations, as well as tools for extensive reporting as part of their payroll system.

However, small businesses often require an online payroll system that includes basic features such as payment, time tracking, and tax filing.

Wrap Up

Through this article you already know the top Payroll Software in 2023. So what is your choice? What other factors are you interested in? Leave a comment below to share your choice.

Tanca provides HR software trial for free, you can experience it.

You may want to see more Top Employee Time Tracking Software in 2022.